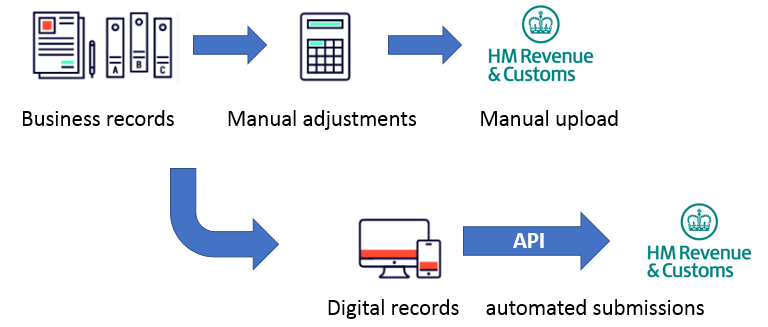

MTD is the government’s vision to have one of the most digitally advanced tax systems in the World. In their words “to improve efficiency and to reduce error”. By forcing businesses to store and share information digitally, HMRC will have quicker access to data and clear audit trails from source documents to filed returns.

The first step in the MTD process focuses on the way VAT return information is stored, processed and communicated and will impact VAT registered business with a taxable turnover greater than the VAT registration threshold (currently £85,000).

From April 2019 “businesses must be capable of keeping and maintaining the records specified in the regulations, preparing their VAT returns using the information maintained in those digital records and communicating with HMRC digitally via an Application Programming Interface (API) platform” (HMRC VAT notice 700/22).

In general, the requirements will place different pressures on businesses depending on how complex their VAT position is. For simple VAT structures there are software solutions available that will quickly make you compliant.

Sadly, for more complex VAT profiles and group companies’ life may not be so straight forward.

Whilst the legislation can be complex the action that each business needs to take can be summarised as follows:

Where is your business now?

You may be in one of the following camps:

1. No digital records

It’s not good news we’re afraid, you need to take action. If you keep manual records, then sooner rather than later you will need to decide on a new accounting system and embrace the new world. Our business services team can help find the best compliant solution for your business.

2. Legacy or bespoke accounting systems

If you use this type of system, then you probably have a lot of work to do. If you have an accounting system that can store digital records but cannot send information directly to HMRC you have two choices.

Firstly, depending on how critical your systems are for running your business, you could change your system to compatible software. There are benefits to doing this, including the potential for quicker information and greater analytics to help better manage your business. On the downside it will require some change, investment and time.

If your software is mission critical to your business and you do not want to replace it, you can use Bridging software. This will involve getting information out of your systems (digitally) into a central processer and then sent to HMRC via an API.

3. Complex group accounting and / or VAT position

HMRC have accepted that not all functional compatible software will be able to deal with complex VAT positions and group accounting and Group VAT registrations. You need to take action to find a solution and have two choices.

Firstly, you could extract your VAT information via digital links to a central processer, undertake your calculations using formula only and use bridging software to share this with HMRC.

Alternatively, if you have functionally compatible software, you can undertake your calculations in your spreadsheets above then upload the required adjustments back into your system and send to HMRC from there.

4. You use an old version of a software system that is not MTDfB compliant

In this instance you can either upgrade to a later version of your software to become compliant, you could switch to another software provider if you are looking for a new way to manage your business or you can go down the bridging software route. All the above options require that you do something.

5. You already use MTDfB compliant software

You are compliant, and these changes will be minor, and you can get on with running your business.

Burgis & Bullock are running a number of free MTD briefings across Warwickshire where we explain MTD in more details and share our vision of how this will likely develop over the next 5-10 years, as well as giving solutions to the challenges MTD presents.

For more information or to book call 0345 177 5500 or visit https://www.burgisbullock.com/events/

Offices in: Leamington Spa • Nuneaton • Stratford-Upon-Avon • Rugby • Leicester • London

0345 177 5500 info@burgisbullock.com www.burgisbullock.com